Get the brochure

View the full syllabus for details on faculty, guest speakers, and learner benefits.

Program overview

Earn Wharton’s globally recognized certificate in Restructuring & Distressed Investing

-

Gain a practical foundation in one of the most complex and misunderstood investment disciplines

This program is designed for investors seeking to identify mispriced distressed opportunities, credit investors evaluating downside and recovery risk, and advisors, consultants, and lawyers who want to better serve clients navigating restructurings and bankruptcies.

-

Learn from leading restructuring professionals, distressed investors, and Wharton faculty

You’ll learn directly from experienced restructuring practitioners and distressed investors alongside Wharton faculty and Wall Street Prep trainers who prepare teams at leading credit funds, PE firms, investment banks, and restructuring advisory practices.

-

Earn a globally recognized certificate

Upon successful completion of the program, participants receive a digital certificate from Wharton Online and join a global community of restructuring professionals, credit investors, and turnaround advisors.

Faculty & Speakers

-

Kevin Kaiser

Program Co-Director, Harris Family Alternative Investments Program, Wharton SchoolView Bio -

Jeff Anapolsky

Program Co-Director, Founder and Managing Partner of Anapolsky AdvisorsView Bio -

Jon Matla

Program Co-Director, Managing Partner at JEM Capital ManagementView Bio

-

Michael Gatto

Program Academic Director, Partner at Silver Point FinanceView Bio -

Bilge Yilmaz

Program Academic Director, Harris Family Alternative Investments Program, Wharton SchoolView Bio

-

Keith Aurzada

Partner and Global Co-ChairView Bio -

Jordan Berger

Managing PartnerView Bio -

Mark Buschmann

Managing Partner and Co-Chief Executive OfficerView Bio -

Adam Cohen

Managing Partner and Portfolio ManagerView Bio -

Tad Davidson

Partner & Co-Lead of Bankruptcy/RestructuringView Bio -

Jim Doak

Head and Managing Director, Capital Structure AdvisoryView Bio -

Andrew Hede

President, Business Transformation & TransactionsView Bio -

Andrew Herenstein

Managing PrincipalView Bio -

Vivian Lau

Managing DirectorView Bio -

Kyung Lee

PartnerView Bio -

Mo Meghji

Managing PartnerView Bio -

Matthew Ray

Founder and Chief Executive OfficerView Bio -

Rachel Strickland

PartnerView Bio -

Josh Sussberg

PartnerView Bio

Applicant profile

The Wharton Online & Wall Street Prep Restructuring & Distressed Investing Certificate Program is designed for professionals from finance, legal, and advisory backgrounds seeking specialized expertise in distressed investing and corporate restructuring.

Turnaround & Restructuring Advisors

Private Equity Professionals

Investment Banking Professionals

Hedge Fund Analysts & Portfolio Managers

Legal Professionals

C-Level Executives and Business Leaders

FP&A & Corporate Finance Professionals

Private Credit Professionals

Students & Career Switcheers

At a Glance: Wharton Online & Wall Street Prep Certificate Learners

Applicant Career Levels

Applicant Industry

Countries Represented

Applicant Employers Include ...

Top Roles Applicants Hold

| 1. | Private Equity Associate/VP |

| 2. | Bankruptcy Law Associate |

| 3. | Restructuring Advisor Associate/VP |

| 4. | Hedge Fund Analyst/PM |

| 5. | Chief Restructuring Officer |

| 6. | Private Credit Associate/VP |

| 7. | Rollup Professional |

| 8. | Chief Financial Officer |

| 9. | Small Business Owner |

| 10. | Investment Banking Associate/VP |

Attend an information session

How you'll learn

The Wharton & Wall Street Prep Restructuring & Distressed Investing Certificate Program is an immersive learning experience made up of self-paced video lectures, real-world exercises, industry case studies, and live office hours

8-Week Restructuring and Distressed Investing Program

Gain the skillset of an experienced restructuring and distressed investing professional in eight weeks.

8-10 Hour Weekly

Time Commitment

A comprehensive certificate program designed to fit into your busy schedule.

Self-Paced Online

Learning Experience

Complete the program on our online learning platform at your own pace.

The Same Training Used by Top Financial Institutions

Access the same lessons and methods taught inside the world’s leading restructuring and distressed Investing teams and organizations.

Learn Directly From Leading Restructuring Professionals

Hear directly from industry experts about best practices and emerging trends in restructuring and distressed investing through our guest speaker series.

Tailored Learning Experience

Through Program Electives

Customize your experience based on your specific learning objectives.

Case Studies That

Capture Perspective

Through real-world exercises and industry case studies, get hands-on expertise in bankruptcy processes, capital structure analysis, distressed M&A, and operational recovery.

Weekly Office Hours

& Dedicated Support

Faculty and support staff are with you every step of the way, offering guidance and live office hours throughout the program.

Earn a Certificate from Wharton Online upon Successful Completion

Upon successful completion of the program, your Wharton Online-issued certificate will be emailed to you in a digital format you can use to demonstrate your achievement on your LinkedIn profile and resume.

Program curriculum

Over the course of eight weeks, master the complete spectrum of corporate restructuring and distressed investing. From diagnosing financial distress to executing turnarounds and distressed investments, you'll gain hands-on expertise in bankruptcy processes, capital structure analysis, distressed M&A, and operational recovery. This self-paced online program culminates in a closing ceremony and the receipt of a certificate from Wharton Online.

Module 1

Introduction to Distress & Distressed Investing

This module introduces the foundations of financial distress and distressed investing. Participants learn what drives companies into distress, how value is created and redistributed across stakeholders, and how investors and advisors assess risk and opportunity in stressed situations. The module blends financial analysis, legal context, and real-world case studies to establish a shared framework for evaluating distressed companies and investment opportunities.

- What is distress and distressed investing?

- The role of value creation in distressed investing

- Identifying the causes and drivers of distress

- Analysis in distressed investing: Sizing the Pie (Valuation)

- Analysis in distressed investing: Splitting the Pie #1 (Priority)

- Analysis in distressed investing: Spitting the Pie #2 (Gaming)

- The legal backdrop of the distressed situation

- Recent developments in the field of distressed investing

Module 2

Decline, Distress, and Turnaround Management

Participants examine how businesses decline, why liquidity crises emerge, and what differentiates solvable operational challenges from structural failure. The module focuses on diagnosing the root causes of distress, managing short-term liquidity through cash controls and forecasting, and understanding the mindset required for effective turnaround leadership. Learners gain insight into how operational decisions directly influence restructuring outcomes and long-term viability.

- Identifying the problem – the financial analysis of Bayfield Generators

- What caused the decline and distress – concepts and cases

- The role of bad management versus bad luck

- The mindset of turnaround management and operational improvement

- The Liquidity Crisis –Control of the cash and the 13-week cash flow forecast

- The Solvency Crisis – Does the company have a right to exist?

- The key questions for understanding the problem and potential paths forward

- Positioning the company for long-term success post-restructuring

Module 3

Restructuring the Right-Hand Side of the Balance Sheet

This module focuses on restructuring the right-hand side of the balance sheet to align a company’s capital structure with its underlying business realities. Participants explore creditor priorities, covenants, and the absolute priority rule, while analyzing modern restructuring tools such as liability management exercises. Case studies illustrate how balance sheet restructurings can preserve enterprise value—or shift control among stakeholders.

- Sizing the Pie in order to know how to Split the Pie

- The objective and process of right-sizing the balance sheet to the business

- The hurdles to right-sizing the balance sheet – introduction to covenants

- The absolute priority rule and understanding priorities and subordination

- The recent rise of Liability Management Exercises (LMEs)

- LME case study #1 – Drop-downs (Toys R Us or J Crew)

- LME case study #2 – Non-pro rate uptiers (Serta and following reversal)

- Restructuring for long-term success (Chesapeake Energy, Hertz, or SAS)

Module 4

Anatomy of the Capital Stack

Participants develop a deep understanding of capital structures and credit documentation, from secured debt to equity and off-balance-sheet obligations. This module demystifies credit agreements, covenants, liens, and intercreditor dynamics, helping learners understand how capital structure design influences outcomes in distress. Emphasis is placed on interpreting legal documents and identifying flexibility—or constraints—within complex financing arrangements.

- Waterfall Analysis

- Key Debt Terminology

Module 5

Entering Bankruptcy

This module provides a practical introduction to Chapter 11 bankruptcy and the early stages of the court-supervised restructuring process. Participants learn the roles of key stakeholders, how the automatic stay functions, and why DIP financing and first-day motions matter. Through applied exercises, learners gain fluency in bankruptcy timelines, filings, and data sources used by investors, advisors, and legal professionals.

- Bankruptcy Boot Camp

- Chief Restructuring Officer (CRO) vs. Trustee vs. Examiner

- Debtor-in-Possession (DIP) Loans

- Introduction to PACER

Module 6

Exiting Bankruptcy

Focusing on value realization and control outcomes, this module examines how companies exit bankruptcy through a plan of reorganization. Participants learn how creditor classes are formed, how valuation disputes are resolved, and how voting and confirmation mechanics work in practice. The module highlights how legal, financial, and strategic considerations converge to determine recoveries and post-emergence ownership.

- Plan of Reorganization

- Subchapter V Small Business Reorganizations

- Single Asset Real Estate Cases

- Valuation Fights

- Avoidance Actions

- Equitable Subordination

- Lender Liability Claims

- Substantive Consolidation

- Lender-on-Lender Violence

Module 7

Art of Distressed M&A

This module explores how assets and companies are bought and sold in distressed situations, both inside and outside of bankruptcy. Participants learn how 363 sales function, how auctions are structured, and how buyers manage risk through transaction design. The module also covers distressed valuation techniques, helping learners assess assets where traditional valuation methods may break down.

Part I: 363 Sales

- Asset Not Stock Sales

- Free and Clear

- Asset Purchase Agreements

- Bidders

- Executory Contracts and Unexpired Leases

- Auction

- Highest and Best Bid

- Objecting to 363 Sales

- Net Operating Losses (NOLs)

Part 2: Distressed Valuation

- Going Concern Valuation

- Liquidation Valuation

- Bankruptcy Claims Trading

- Valuation of Intangibles

Module 8

Operational Turnarounds

Participants learn how operational execution drives restructuring success. This module focuses on liquidity management, working capital optimization, cost controls, and performance improvement in distressed environments. Learners explore how leadership changes, cash discipline, and operational decision-making can stabilize businesses and support restructuring efforts. Emphasis is placed on translating financial plans into operational results.

- Managing Liquidity

- “Bottom Up” Forecasts

- Change Management

- Integrating Prior Acquisitions

- EBITDA Adjustments

- Rebuilding the Balance Sheet

- Federal Bankruptcies vs. State Foreclosures

Module 9

Distressed Maneuvers

The final module examines advanced distressed strategies, including liability management transactions and special situations investing. Participants learn how investors generate returns through control strategies, capital structure arbitrage, claims trading, and liquidation scenarios. The module connects restructuring mechanics to investment outcomes, helping learners understand how professionals deploy capital across different distressed scenarios.

Part 1: Liability Management Exercises

- Amend-and-Extend

- Exchange Offers

- Asset Stripping / Drop-Downs

- Uptiering

- Co-op agreements

Part 2: Investment Strategies

- Underwriting Special Situations

- Spread Tightening Trades

- Fundamental Value Plays

- Distressed for Control

- Capital Structure Arbitrage

- Trade Claims and Vendor Puts

- Liquidations

- Unique Special Situations Trades

Tuition & payment options

OR

Join a Global Network

Join a Global Career Support Network

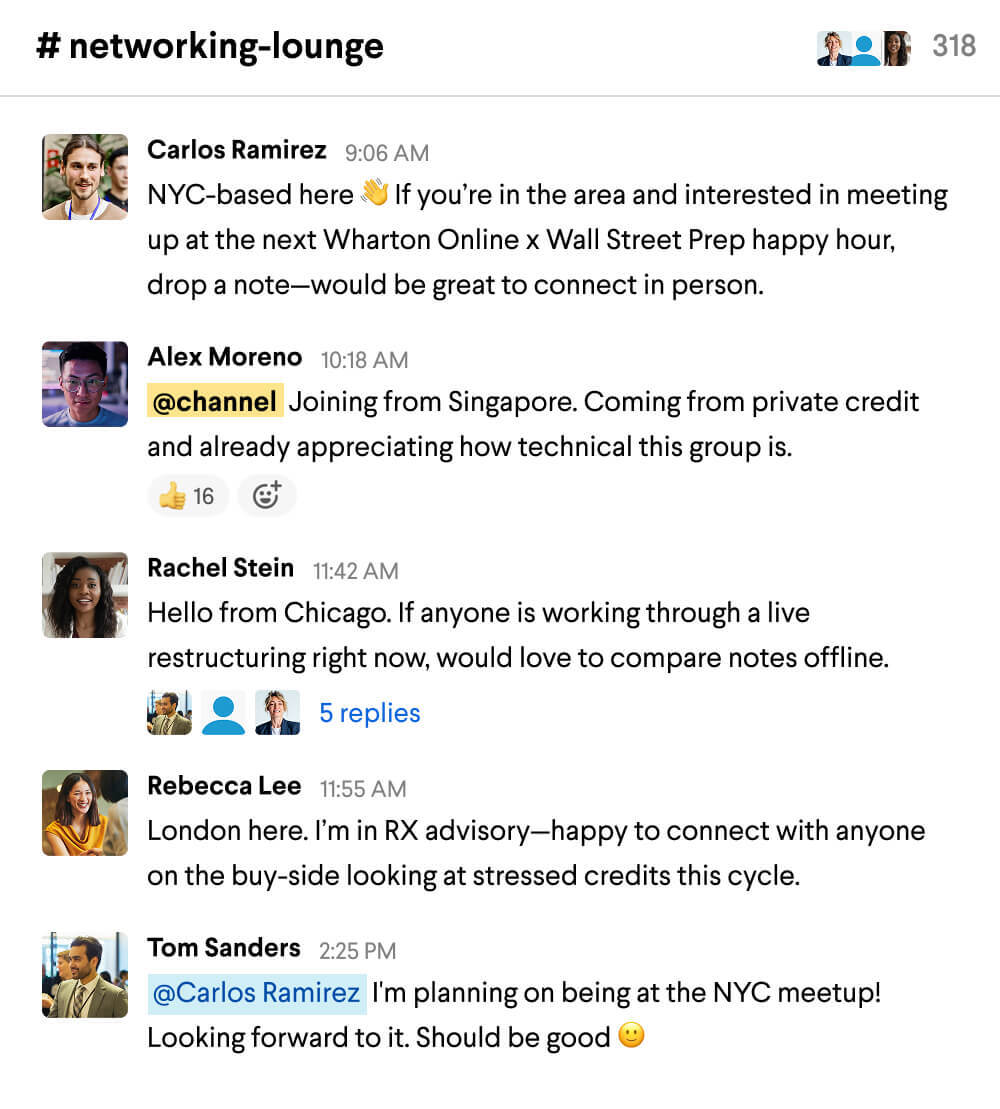

Enrollees join a highly engaged global network committed to mutual support. Relationships built during the program are strengthened through in-person and virtual meetups, discussion groups, and networking events.

Invitation-Only Wharton/Wall Street Prep Group on LinkedIn

Participants receive an invitation to join the Wharton Online / Wall Street Prep Restructuring & Distressed Investing Certificate Program Group on LinkedIn. Here, graduates can connect with the entire program network, seek advice, and access exclusive online events and resources.

Local Connection for a Global Certificate

Program graduates come from 100+ countries, so while the program is global, connection is often created locally. Participants gain access to their Local Graduate Slack Channel, designed to facilitate local connection for a global certificate.

Cross-Program Networking Events

Enrolling in a Wharton Online & Wall Street Prep Certificate Program is a unique opportunity to expand your professional network beyond your specific industry. Enrollees attend cross-program events attended by other Certificate Program learners and graduates in investment banking, private equity, hedge funds, asset management, venture capital, financial planning and analysis (FP&A) and other career tracks.

For Employers: Develop Restructuring & Distressed Investing Expertise Across Your Team

Private Equity, Credit & Special Situations

Build deal-ready distressed investors with practical modeling skills

- Train analysts and associates in distressed debt analysis, downside modeling, and restructuring frameworks

- Accelerate desk readiness through real-world case studies, LMEs, and applied investing tools

Investment Banks & Restructuring Advisory

Strengthen restructuring and special situations coverage

- Upskill teams across restructuring, leveraged finance, bankruptcy processes, and creditor dynamics

- Enable more effective advisory in complex, distressed client situations

Consulting, Accounting & Legal Firms

Support distressed and restructuring engagements with confidence

- Build practical restructuring fluency and improve collaboration with PE, credit, and banking clients

FAQs

How often are programs offered?

Programs will be offered three times each year. Cohorts will begin in February, June, and October.

How much time will it take to complete this certificate?

The course is designed to run for eight weeks, with a recommended workload of 8-10 hours of lectures, live sessions, and assignments per week.

What languages will the program be offered in?

This program is offered in English only.

How do I register for this program?

You can register for the program at any time through our Enrollment Form.

How much does the program cost?

Program tuition is $4,800. Tuition can be paid in full or in 5 monthly payments.

Do you offer tuition assistance?

Tuition assistance will be available for every cohort. Use our Tuition Assistance form to apply.

What is the program refund policy?

This program is non-refundable.

Who can I contact for additional questions?

If you have any additional questions, please reach out to our enrollment team at enrollment@wharton.wallstreetprep.com.