Get the brochure

View the full program syllabus as well as details on faculty, guest speakers and key learner benefits.

Program overview

Level up your real estate investing career

Upon program completion, participants receive a digital certificate issued by Wharton Online

-

The world's most recognized real estate investing certificate program

Learn to analyze real estate investments, blending investment theory, with real world financial modeling and analysis as it is done at the world’s leading real estate investment firms.

-

Learn institutional-grade real estate analysis

The barriers to entry in real estate are low but the barriers to success are high. Learn to approach real estate with an institutional lens that will differentiate you as both a professional and entrepreneur.

-

Learn from world renowned faculty and experienced real estate investors

You'll learn directly from legendary faculty, industry practitioners and executives at some of the world's leading real estate firms.

Applicant profile

The Wharton & Wall Street Prep Real Estate Investing & Analysis Certificate Program is designed for finance professionals in their early to mid career seeking to understand institutional-grade real estate analysis.

Commercial Real Estate (CRE) Professionals

Investment Bankers

Brokers

Professional Services

Family Offices

Private Investors

Private Lenders

Support Roles

Career Switchers

Students

At a Glance: May 2024 Cohort

Applicant Career Levels

Applicant Industry

Countries Represented

Applicant Employers Include ...

Top Roles Applicants Hold

| 1. | Real Estate Investment Analyst |

| 2. | Acquisitions Analyst |

| 3. | Asset Management Analyst/Associate |

| 4. | Asset Manager |

| 5. | Portfolio Manager |

| 6. | Loan Underwriter |

| 7. | Capital Markets Analyst/Associate |

| 8. | Financial Analyst |

| 9. | Investment Banking Analyst |

| 10. | Development Manager |

8-Week Program

Focusing on Real Estate

8-10 Hour Weekly

Time Commitment

Self-paced Online

Learning Experience

Learn By Doing

With Real Case Studies

How You'll Learn

How You'll Learn

The Wharton & Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive learning experience made up of self-paced video lectures, real-world exercises, industry case studies and full faculty support.

Learn Directly From

Top Real Estate Investors

Tailored Learning

Through Electives

The Same Training Used

by Top Real Estate Firms

Weekly Office Hours

& Dedicated Support

Program curriculum

Over the course of eight weeks, you will learn the concepts and practical technical methods that real estate investment professionals deploy in analyzing and executing real estate transactions. Delivered in a weekly self-paced online format, the program culminates in a closing ceremony and the receipt of a Certificate from Wharton Online.

Module 1

Introduction to the Real Estate Asset Class

Module 1 serves as the cornerstone of the learning journey, offering an in-depth exploration of real estate as an asset class, the operational dynamics of real estate investment firms, and how to create value in real estate.

- History & evolution of real estate as an asset class

- Common investment strategies & property types

- Various real estate stakeholders & their respective roles in investments

- Real estate within the private market and alternatives ecosystem

Module 2

The Real Estate Investment Framework

Module 2 provides a comprehensive overview of essential components in real estate investment, focusing on the investment approach, valuation methods, and various frameworks utilized in the industry.

- Foundations of real estate finance: NOI, cap rates, value, and returns

- Introduction to valuation methods: income cap, DCF, comparables, and replacement cost

- What is a real estate pro forma

- Measuring investment returns

Module 3

Financing and Taxation of Real Estate

Module 3 delves into the intricacies of real estate structuring and financial engineering, focusing on common capital structures, tax considerations, and performance incentives within cash flow waterfalls.

- Capital structures and leverage

- Tax benefits and depreciation

- Joint venture structure, management responsibilities, & the GP/LP relationship

- Cash flow waterfalls & performance incentives

Module 4

The Real Estate Deal Process

Module 4 immerses participants in the real-world intricacies of the real estate deal process. The focus is on bringing to life the key stages of an investment, from sourcing to business plan execution to disposition.

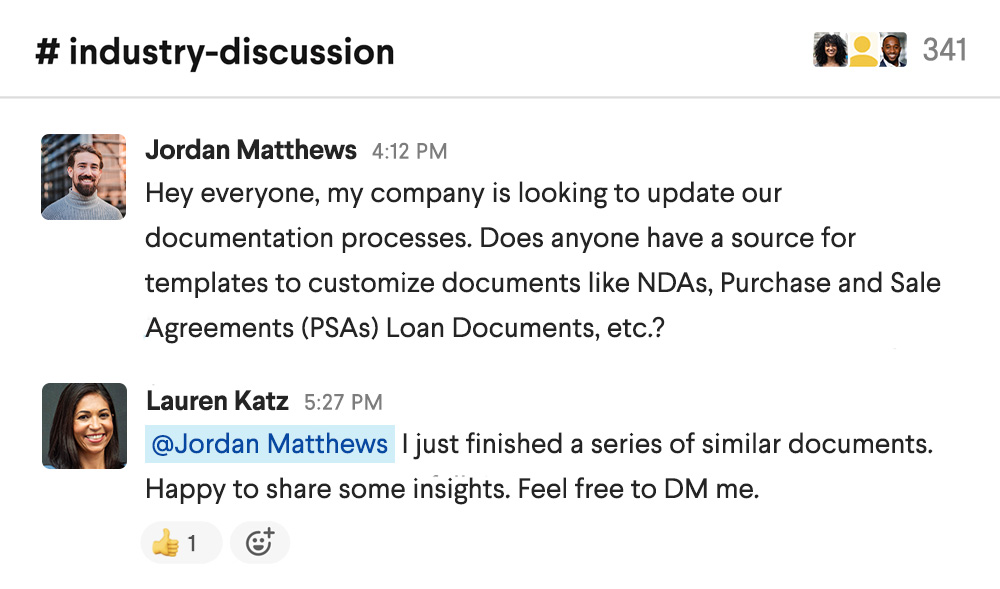

- Anatomy of the deal process: stages, workstreams & responsibilities

- The role of third parties & their functions

- Deal docs: NDAs, teaser, OMs, LOIs, PSAs, & loan document

- Key terms, due diligence items, and points of negotiation in an acquisition

Module 5

Real Estate Investment Analysis & Financial Modeling, Part 1

Module 5 begins participant’s deep dive into real estate financial modeling. This module explores how real estate professionals analyze and underwrite investment opportunities, with a specific focus on modeling property-related cash flow proformas.

- Property level financial modeling fundamentals & best practices

- Multifamily, industrial, retail, and office operating cash flow builds

- Capital expenditure & other non-operating cash flow builds

- Defining & calculating net operating income (NOI)

- Acquisition and disposition values (direct capitalization method)

Module 6

Real Estate Investment Analysis & Financial Modeling, Part 2

Module 6 continues the focus on real estate financial modeling. Students deepen their understanding of investment underwriting, specifically focusing on financing and capital structures. Participants explore modeling debt structures and levered cash flows, gaining insights into the intricacies of financing and its impact on investment returns.

- Debt structures & levered cash flows

- Investment returns - internal rate of return, multiple on invested capital, cash-on-cash yield, yield-on-cost

- Joint venture waterfalls & promote structures

- Acquisition vs. development models

- Using an investment model to inform investment decisions

Module 7

Analyzing Market Risk Factors

Module 7 delves into the strategic thinking processes employed by real estate professionals when evaluating investment opportunities, focusing on both macro and micro market analysis. Market dynamics are explored, including demand drivers, supply-side considerations, and the impact of volatility on investments.

- Supply & demand dynamics

- Analyzing economic data

- Market rents & forecasting growth

- Market analysis

Module 8

Analyzing Property Level Risk Factors

Module 8 continues the focus on strategic thinking processes employed by real estate professionals when evaluating investment opportunities, focusing on property-level risks. Emphasis is placed on risk management and the concept of risk mitigation, utilizing leases and mortgages to align risk and return dynamics with investor requirements.

- Identifying & mitigating micro risk factors

- Identifying & mitigating macro risk factors

- Balancing risk & return

Module 9

Capstone Project: Investment Case Study

In the final module, participants are immersed in the practical application of the entire real estate investment process, covering transaction structuring, investment underwriting, due diligence, and analysis.

- Partnership structure & execution plan

- Due diligence

- Underwriting & financial analysis (upside, base, and downside cases)

- Investment highlights & risks

- Investment recommendation

Faculty & speakers

-

Todd Sinai

Professor of Real Estate, Real Estate Department Chair, Wharton SchoolView Bio -

Benjamin Keys

Professor of Real Estate and Finance, Wharton SchoolView Bio -

Jessie Handbury

Associate Professor of Real Estate, Wharton SchoolView Bio -

Aaron Hancock

Real Estate Program Director, Wall Street PrepView Bio -

Daniel Mann

Real Estate Program Director, Wall Street PrepView Bio -

Aaliyah Ameer

Senior Instructor, Wall Street PrepView Bio -

Karine Blanc

Senior Instructor, Wall Street PrepView Bio -

Daniel Erb

Senior Instructor, Wall Street PrepView Bio -

Matan Feldman

Founder and CEO, Wall Street PrepView Bio -

JB Gough

Senior Instructor, Wall Street PrepView Bio -

Lindsay Tsumpes

Senior Instructor, Wall Street PrepView Bio -

Eric Bergin

![Company logo]() Founder, Top Shelf ModelsView Bio

Founder, Top Shelf ModelsView Bio

-

Dean Adler

![Company logo]() Founder & CEO, Lubert-AdlerView Bio

Founder & CEO, Lubert-AdlerView Bio -

Jeff T. Blau

CEO, Related CompaniesView Bio -

Anar Chudgar

Co-President, Artemis Real Estate PartnersView Bio -

Hal Fetner

President & CEO, Fetner PropertiesView Bio -

Deborah Harmon

Co-Founder & Co-CEO, Artemis Real Estate PartnersView Bio -

Chris Lee

Co-President & Partner, KKR Real EstateView Bio -

Evan Levy

![Company logo]() Vice Chairman, The Amherst GroupView Bio

Vice Chairman, The Amherst GroupView Bio -

Christopher Méndez

Managing Director, PearlmarkView Bio -

Alan Ratner

![Company logo]() Managing Director, Zelman & AssociatesView Bio

Managing Director, Zelman & AssociatesView Bio -

Michael Vu

Senior Managing Director, Artemis Real Estate PartnersView Bio -

Simon Ziff

President, Ackman-Ziff Real Estate GroupView Bio

Tuition & payment options

OR

Join a Global Network

Enrollees access a large and highly engaged global network of peers who are committed to give us much as they get and to support one another. Connections built throughout the program are strengthen via in person and virtual meetups, discussion groups and networking events.

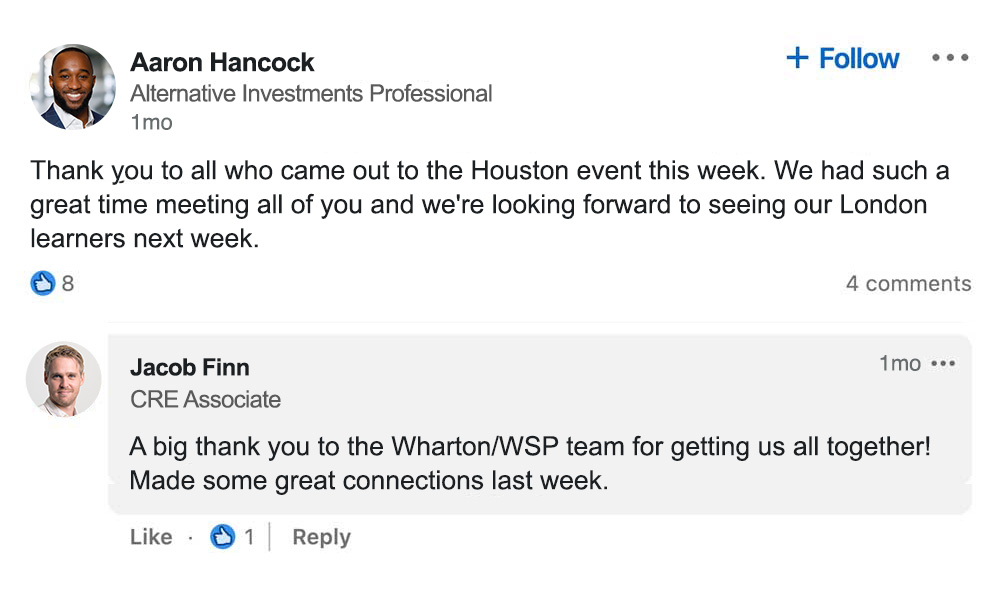

Invitation-Only Wharton/Wall Street Prep Group on LinkedIn

Upon completion of the program, graduates receive an invitation to join the Wharton Online / Wall Street Prep Real Estate Investing & Analysis Certificate Program Alumni Group on LinkedIn. Through this group, graduates can directly connect with the entire graduate network, seek advice and access graduate-only online events and resources.

Local Connection for a Global Certificate

Program graduates come from over 40 countries, so while the program is global, connection is often created locally. Graduates gain access to their Local Alumni Slack Channel, designed to facilitate local connection for a global certificate.

Cross-Program Networking Events

Enrolling in a Wharton Online & Wall Street Prep Certificate Program is a unique opportunity to expand your professional network beyond your specific industry. Enrollees attend cross-program events attended by other Certificate Program learners and graduates in investment banking, private equity, hedge funds, asset management, venture capital, financial planning and analysis (FP&A) and other career tracks.

For Employers: Level up your professional development

Real Estate Private Equity Firms

- Accelerate the new hire training timeline.

- Better compete for talent against large firms with extensive in-house training resources.

Owner/Operators & Developers

- Institutionalize your underwriting and diligence processes.

- Grow your portfolio by creating efficiencies in your execution processes.

Vendors

- Better understand how your services and products fit into the real estate investment process.

- Equip your sales force to recognize opportunities to add value across your client’s investment processes.

FAQs

How often are programs offered?

Programs will be offered three times each year. Cohorts will begin in February, June, and October.

How much time will it take to complete this certificate?

The course is designed to run for eight weeks, with a recommended workload of 8-10 hours of lectures, live sessions, and assignments per week.

What languages will the program be offered in?

This program is offered in English only.

How do I register for this program?

You can register for the program at any time through our Enrollment Form.

How much does the program cost?

Program tuition is $4,800. Tuition can be paid in full or in 5 monthly payments.

Do you offer tuition assistance?

Tuition assistance will be available for every cohort. Use our Tuition Assistance form to apply.

What is the program refund policy?

This program is non-refundable.

Who can I contact for additional questions?

If you have any additional questions, please reach out to our enrollment team at enrollment@wharton.wallstreetprep.com.