Get the brochure

View the full syllabus as well as details on faculty, guest speakers and learner benefits.

Program overview

Level up your career with Wharton's globally recognized Private Equity Certificate Program

-

Career-focused Private Equity training

Learn to analyze private equity investments, blending investment theory with real world analysis as it is done at the world’s leading private equity investment firms.

-

Learn from top faculty and practitioners

You'll learn directly from Wharton School faculty, top PE corporate training instructors and senior executives at some of the world's leading Private Equity firms.

-

Gain a globally recognized certificate

At the conclusion of the 8-week program, participants receive a digital certificate from Wharton Online and program graduate access to lifelong career resources.

Who Applies to the Program?

The Wharton & Wall Street Prep Private Equity Certificate Program is designed for both finance and non-finance professionals in their early to mid career seeking to understand private equity investing.

Investment Professionals

Investment Bankers

Sponsors & Search Funds

Professional Services

Family Offices

Private Lenders

Support Roles in Private Equity

Career Switchers

Students

At a Glance:

Program Learners & Graduates

Applicant Career Levels

Applicant Industry Distribution

1 Non-Investment Real Estate

2 Non-Real Estate

Countries Represented

Top Roles Applicants Hold

| 1. | Investment Banking Analyst |

| 2. | Investment Associate |

| 3. | Private Equity Associate |

| 4. | Associate (Consulting) |

| 5. | Senior Associate (Consulting) |

| 6. | Private Equity Analyst |

| 7. | Financial Analyst (Corporate Finance) |

| 8. | Chief Financial Officer |

| 9. | Investment Analyst |

| 10. | Investment Banking VP |

Applicant Employers Include ...

Attend a program information session

Get our schedule of upcoming live virtual info sessions:

Attend an information session

How you'll learn

The Wharton & Wall Street Prep Private Equity Certificate Program is an immersive learning experience made up of self-paced video lecture, real-world exercises, industry case studies and full faculty support

8-Week Program

Focusing on Private Equity

Gain the skillset of an early- to mid-level Private Equity professional.

8-10 Hour Weekly

Time Commitment

A comprehensive certificate program designed to fit into your busy schedule.

Self-paced Online

Learning Experience

Complete the program on our online learning platform at your own pace.

The Same Training

Used by Top PE Firms

Access the same lessons and methods taught inside the world’s leading PE firms.

Learn Directly From

PE Industry Leaders

Hear directly from the best about PE investing and the latest industry trends via our guest speaker series.

Tailored Learning Experience

Through Program Electives

Customize your experience based on your specific learning objectives.

Case Studies That

Capture Perspective

Learn first-hand how top PE firms execute deals, analyze companies and evaluate investment opportunities.

Weekly Office Hours

& Dedicated Support

Program faculty and support staff is available every step of the way.

PE Certification

Issued from Wharton Online

Upon completion of the program, you will receive a Certificate of Completion from Wharton Online.

Program curriculum

Over the course of eight weeks, you will learn the concepts and practical technical methods investment professionals deploy in both evaluating and executing private transactions. Delivered in a weekly self-paced online format, the program culminates in a closing ceremony and the receipt of a Certificate from Wharton Online.

Module 1

Introduction to the Private Equity Asset Class & Investment Framework

The foundation for your learning experience is an overview of the private equity asset class, how private equity firms function, and the investment approaches, value creation strategies, and valuation methods deployed by private equity firms.

- History & Evolution of Private Equity as an Asset Class

- Fund Structure, Management & the General Partner /Limited Partner Relationship

- Private Equity within the Private Market and Alternatives Ecosystem

- Current State of Private Equity in Emerging Markets

- Common Investment Strategies

- LBO Analysis, Hurdle Rates and Returns

- Leverage as Tool for Value Creation in Private Equity

Module 2

The Private Equity Deal Process

Practical exercises, real life examples and case studies bring the private equity deal process to life. In this module, we explore the end‑to‑end corporate buyout process, including key workflows, roles and responsibilities on the deal team, and all of the key documents and deliverables that investment professionals encounter throughout the process.

- Anatomy of the Deal Process: Stages, Workstreams & Responsibilities

- Deal Documents: NDA, CIM, IC memos, IOI/LOI, financing indications & commitment letters, SPA/APA, TSA, funds flow, credit agreements.

- Key Terms and Points of Negotiation in a Transaction

- The Role of Third Parties & Their Functions

Module 3

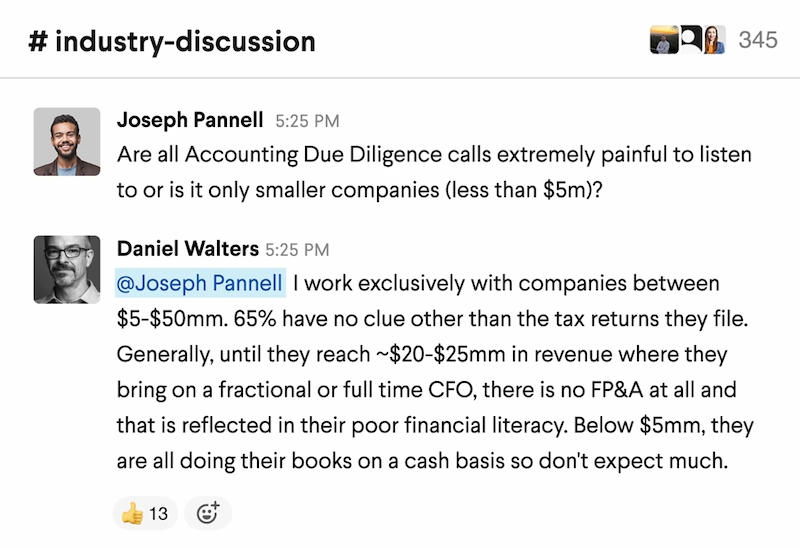

Leverage, Accounting Diligence & Deal Structuring

Understand financing options and constraints, EBITDA and net working capital, various adjustments and the QoE report, how purchase price allocation works, how structuring a deal as either a stock or asset purchase shapes taxes, proceeds, and returns, and buyer vs. seller preferences.

- Leveraged Finance, Private Credit and Capital Structures

- EBITDA, Working Capital and the Quality of Earnings

- M&A Accounting, Purchase Price Allocation and Tax Implications

- Deal Structuring: Asset Sales/338(h)(10) vs Stock Sales

- Impact of Deal Structure on Seller Proceeds, Cash Flow and Sponsor Returns

Module 4

Private Company Analysis, Valuation & LBO Modeling, Pt. 1

Using real case studies of both private and public investments, here you’ll build the analytical base for a middle‑market LBO, including private‑company analysis, valuation methodologies, and how to create robust forward projections that you’ll carry into a transaction model.

- Private vs. Public Company Analysis

- Valuation Methodologies: DCF, Trading and Transaction Comps, LBO, football-field presentation

- Middle Market Transaction Simulation & Case Study

- Defining & Calculating EBITDA

- Financial Modeling Best Practices

- Income Statement and Balance Sheet Projections

Module 5

Private Company Analysis, Valuation & LBO Modeling, Pt. 2

Through the completion of the middle market transaction simulation & case study, this module walks through a detailed LBO model build, and explores how to layer in transaction mechanics, debt schedules and covenants; integrate operating assumptions; and use the LBO to frame and construct an investment recommendation.

- Bottom-Up LBO Model Build

- Operating Model Build & LBO Integration

- Developing Transaction & Model Assumptions

- Using the LBO Model to Inform Investment Recommendations

- How to Construct an Investment Recommendation

Module 6

Thinking Like a Private Equity Professional, Pt. 1

This module begins to explore how private equity professionals think about investment opportunities in the context of the due diligence process. In this module, you’ll learn how to build a view on industries, moats, growth, and intrinsic value, and how diligence questions translate into modeling assumptions.

- Understanding Industries and TAMs

- Barriers to Entry & Competitive Advantages

- The Data Room Loop and Working with Management Data

- The Operating Model and Drivers of Value

- Business Segmentation & Revenue Builds

Module 7

Thinking Like a Private Equity Professional, Pt. 2

This module continues the operating model deep dive and covers cost structures, expense modeling, and data analysis. The module concludes with an in-depth look at recurring revenue businesses and the Software-as-a-Service (“SaaS”) business model, and explores how AI applications are being applied across the Private Equity space.

- Cost Structures & Expense Modeling

- Data Analysis & the Due Diligence Process

- The Data Room Loop: Working with Management Data

- The SaaS Model & Recurring Revenue Builds

- AI Applications in Private Equity

Module 8

LBO Fundamentals & the Private Equity Case Interview

The final module is designed to reinforce your conceptual and technical understanding of the mechanics of an LBO. In this module, you will build an LBO model from the ground up in the context of a private equity case interview. This exercise will sharpen your understanding of how to build an LBO model efficiently, communicate information clearly, and show good judgment related to operating and exit assumptions and sensitivities.

- LBO Intuition & Set Up

- Key Value Drivers in an LBO Transaction

- Bottom‑Up LBO Build Using a Case Prompt

- Model Sources & Uses and Management Rollover

- IS, BS and CFS projections

- Debt and Interest Rate Schedule Builds

- Exit Value, Returns & Sensitivity Tables

Faculty & speakers

-

Dr. Burcu Esmer

Co-Director, Harris Family Alternative Investments Program, Wharton SchoolView Bio -

David Musto

Ronald O. Perelman Professor in Finance, Wharton SchoolView Bio -

Scott Roman

Private Equity Program Director, Wall Street PrepView Bio

-

David Rubenstein

Co-Founder and Co-Chairman of the Board, Carlyle GroupView Bio -

Steven Rattner

Chairman, Willett Advisors; Op-Ed Writer, New York TimesView Bio -

Marc Ganzi

CEO, DigitalBridgeView Bio

-

Martin Brand

Head of North America Private Equity, BlackstoneView Bio -

Ed Brandman

![Company logo]() Founder and CEOView Bio

Founder and CEOView Bio -

Dina Dwyer

![Company logo]() Managing Partner, Eden CapitalView Bio

Managing Partner, Eden CapitalView Bio -

Carl Chan

Senior Vice President, Thoma BravoView Bio -

Paul Condra

Global Head of Private Markets ResearchView Bio -

Marc Ganzi

CEO, DigitalBridgeView Bio -

Scott Graves

Founder, Chief Executive Officer, and Chief Investment OfficerView Bio -

Jennifer James

Managing Director, Thoma BravoView Bio -

AJ Jangalapalli

Principal, Thoma BravoView Bio -

David C. Lee

Partner, Gibson DunnView Bio -

Martins Mellens

Global Private Equity Practice LeadView Bio -

Carl Press

Partner, Thoma BravoView Bio -

Steven Rattner

Chairman, Willett Advisors; Op-Ed Writer, New York TimesView Bio -

David Rubenstein

Co-Founder and Co-Chairman of the Board, Carlyle GroupView Bio -

Ruban Selvakumar

![Company logo]() Chief Customer OfficerView Bio

Chief Customer OfficerView Bio -

David Schuppan

![Company logo]() Senior Partner and Co-Head of HealthcareView Bio

Senior Partner and Co-Head of HealthcareView Bio -

Nizar Tarhuni

Senior Director, PitchBookView Bio -

Vanessa Webb

Partner, Oliver WymanView Bio -

Larry Wiesneck

Co-President & Head of Investment Banking, CowenView Bio

-

Dr. Burcu Esmer

Co-Director, Harris Family Alternative Investments Program, Wharton SchoolView Bio -

Ayodele Ekhator

Senior Instructor, Wall Street PrepView Bio -

Matan Feldman

Founder and CEO, Wall Street PrepView Bio -

Zach Freeman

Senior Instructor, Wall Street PrepView Bio -

Jessica Holton

Senior Instructor, Wall Street PrepView Bio -

Marc Howland

Senior Instructor, Wall Street PrepView Bio -

Adam McGowan

Senior Instructor, Wall Street PrepView Bio -

David Musto

Ronald O. Perelman Professor in Finance, Wharton SchoolView Bio -

Lidia Napier

Senior Instructor, Wall Street PrepView Bio -

Zach Ranen

Senior Instructor, Wall Street PrepView Bio -

Scott Roman

Private Equity Program Director, Wall Street PrepView Bio -

Christopher Reilly

M&A and FP&A ConsultantView Bio -

Michael Stack

Senior Instructor, Wall Street PrepView Bio -

Alex Stoyanov

Senior Instructor, Wall Street PrepView Bio

Networking Events & Program Benefits

Successfully completing the Private Equity Certificate Program unlocks access to exclusive events including in person networking events and meet ups, roundtables with leading Private Equity recruiters, and fireside chats with the world's leading Private Equity investors and industry stakeholders.

Peer-to-Peer Networking

Enrollees access a large and highly engaged global network of peers who are committed to give as much as they get and to support one another. Program graduates reinforce and strengthen connections built throughout the program via in person and virtual meetups, discussion groups and networking events.

Invitation-Only Wharton/Wall Street Prep Group on LinkedIn

Upon completion of the program, graduates receive an invitation to join the Wharton Online / Wall Street Private Equity Certificate Program Alumni Group on LinkedIn. Through this group, graduates can directly connect with the entire graduate network, seek advice and access graduate-only online events and resources.

Local Connection for a Global Certificate

Program participants come from over 40 countries, so while the program is global, connection is often created locally. Graduates gain access to their Local Alumni Slack Channel, designed to facilitate local connection for a global certificate.

Exclusive Recruiting Events

Upon completion of the program, graduates gain exclusive access to intimate, small group roundtables, workshops and events hosted by the world’s top private equity recruiters. Events are curated to accommodate the varied expertise, experience and geographic locations of graduates.

For Employers: Level up your firm's professional development

Private Equity & Investment Firms

Strengthen your internal talent pipeline

- Accelerate the desk readiness of your investment professionals

- Sponsor non-investment professionals to align technology, operations, and back office roles with investment professionals

- Develop new hires and strengthen your internal talent pipeline

Professional Services

Better serve your private equity clients

- The world’s leading investment banks, consulting, TAS, accounting and law firms have chosen the Private Equity Certificate Program to develop incoming talent and upskill existing employees to better serve their private equity clients.

FAQs

How often are programs offered?

Programs will be offered three times each year. Cohorts will begin in February, June, and October.

How much time will it take to complete this certificate?

The course is designed to run for eight weeks, with a recommended workload of 8-10 hours of lectures, live sessions, and assignments per week.

What languages will the program be offered in?

This program is offered in English only.

How do I register for this program?

You can register for the program at any time through our Enrollment Form.

How much does the program cost?

Program tuition is $4,800. Tuition can be paid in full or in 5 monthly payments.

Do you offer tuition assistance?

Tuition assistance will be available for every cohort. Use our Tuition Assistance form to apply.

What is the program refund policy?

This program is non-refundable.

Who can I contact for additional questions?

If you have any additional questions, please reach out to our enrollment team at enrollment@wharton.wallstreetprep.com.