Get the brochure

View the full program syllabus as well as details on faculty, guest speakers and key learner benefits.

Program overview

Elevate your finance career with Wharton's globally recognized FP&A Certificate Program

-

Career-focused Financial Planning & Analysis (FP&A) training

Master the art of forecasting, analysis, business partnering, and financial storytelling, combining technical and interpersonal skills with real-world applications as practiced in top corporations.

-

Learn from top faculty and industry leaders

Benefit from the wealth of knowledge shared by distinguished faculty from the Wharton School, experienced FP&A professionals and senior executives from renowned global companies.

-

Gain a globally recognized certificate

Upon successful conclusion of the 8-week program, participants will be awarded a digital certificate from Wharton Online, along with lifetime access to career resources and a network of program graduates.

Applicant profile

The Wharton & Wall Street Prep Financial Planning & Analysis (FP&A) Certificate Program is designed for both finance and non-finance professionals in their early to mid-career seeking to level up their FP&A skills.

FP&A Analysts & Managers

Finance Professionals

Accountants

Consultants

Business Leaders

Non-Finance Professionals

Career Switchers

Students

Applicant Career Levels

Professional Backgrounds

Top Roles Applicants Hold

| Role | Average Salary (US) | # of Professionals Globally |

|---|---|---|

| Financial Analyst | $60k - $85k | 500,000+ |

| FP&A Manager | $100k - $130k | 50,000+ |

| Senior Financial Analyst | $75k - $95k | 200,000+ |

| Budget Analyst | $55k - $75k | 50,000+ |

| Corporate Finance Manager | $90k - $120k | 40,000+ |

| Strategic Planning Analyst | $70k - $90k | 30,000+ |

| Finance Director | $120k - $160k | 30,000+ |

| Business Finance Consultant | $80k - $110k | 60,000+ |

| Chief Financial Officer (CFO) | $150k - $300k+ | 20,000+ |

| Treasury Analyst | $60k - $80k | 40,000+ |

Countries Represented

Applicant Employers Include ...

Attend a program

information session

Get our schedule of upcoming live virtual info sessions:

Attend an information session

How you'll learn

The Wharton & Wall Street Prep Financial Planning & Analysis (FP&A) Certificate Program is an immersive learning experience made up of self-paced video lecture, real-world exercises, industry case studies and full faculty support

8-Week Program Focusing

on Financial Planning & Analysis

Gain the skillset of an experienced FP&A professional in eight weeks.

8-10 Hour Weekly

Time Commitment

A comprehensive certificate program designed to fit into your busy schedule.

Self-paced Online

Learning Experience

Complete the program on our online learning platform at your own pace.

The Same FP&A Training

Used by Top Corporations

Access the same lessons and methods taught inside the world’s leading FP&A teams.

Learn Directly from CFOs and FP&A Professionals

Learn from finance leaders across the corporate spectrum - from global enterprise to PE-backed private companies.

In-Person & Virtual

Networking Events

Attend exclusive networking events throughout the program and build out your professional network.

Learn By Doing With

Real Case Studies

Create forecasts, manage budgets, and support decisions through financial analysis, and tell the financial story of the business as you would on the job.

Weekly Office Hours

& 1:1 Coaching

Program faculty is there for you every step of the way.

FP&A Certification

Issued from Wharton Online

Upon completion of the program, you will receive a Certificate of Completion from Wharton Online.

Program curriculum

Over the course of eight weeks, you will learn forecasting, analysis, business partnering, and financial storytelling in a curriculum that combines technical and interpersonal skills with real-world applications practiced at top corporations. This self-paced online program culminates in a closing ceremony and the receipt of a certificate from Wharton Online.

Module 1

Introduction to Financial Planning & Analysis (FP&A)

This module introduces the FP&A profession and its role in businesses of various sizes across different industries. We then examine common FP&A work products, evaluate current and emerging tools of the trade, and introduce a key skill set for FP&A professionals: strategic cost accounting.

- Examination of forecasts, budgets, variance analyses, scorecards, dashboards, and management decks.

- Understanding FP&A’s tools of the trade, including Excel, data analysis, visualization software, and emerging AI technologies

- Introduction to Strategic Cost Accounting in the context of FP&A

Module 2

The Planning Cycle and Annual Budgeting

We review best practices for long-range planning and effectively managing the five phases of the annual budgeting process. The module covers how to get more out of your planning process by collaborating closely with the cross-functional team.

- In-depth review of the planning process, including long-range planning and annual budgeting

- Best practices for top-down and bottom-up planning jointly with the cross-functional team

- How to best manage the planning process with Excel

Module 3

Forecasting

You will learn the forecasting techniques that are used today by major firms, including time series analysis, driver-based planning, sales pipeline forecasting, zero-based budgeting, and scenario planning methods. We cover methods for accurately projecting sales, expenses, cash flow, headcount, and capex.

- Step-by-step forecasting technique reviews, including hands-on practice

- Using scenario planning to identify risks and opportunities and develop mitigation plans

- Improving forecast accuracy by identifying and addressing forecast bias

Module 4

Financial Analysis in FP&A

The module covers the financial analysis process end-to-end, from data cleaning over evaluating data quality to identifying cost-saving opportunities, variance analysis commentary, and using operational metrics to spot trends early.

- Best practices for data preparation and quality

- Learn how to identify cost savings, risks, and opportunities

- Create variance analysis commentary that uncovers actionable insights

Module 5

Financial Modeling for Decision Support

We cover how to create financial models from scratch in Excel using commonly accepted modeling standards. The module covers the financial model types top finance teams use to make go / no-go decisions about major investments, such as Payback, Return on Investment, Life Time Value (LTV), and Discounted Cash Flow models.

- Excel modeling standards and best practices

- Financial Statement and DCF modeling

- Break-even analysis and getting to answers without modeling

Module 6

Finance Business Partnering

You will learn how to build strong professional relationships and influence, preparing you to become a strategic advisor to the business. We cover developing business acumen and using it to raise accountability, challenge assumptions, and create visibility of business performance while protecting the relationship.

- Developing a broad understanding of the business

- Building trust and holding people accountable while maintaining relationships

- Influencing skills and challenging assumptions with data

Module 7

Reporting, Presenting, and Storytelling

The module teaches how to effectively communicate financial information, be it in written form or when presenting live. It provides a deep dive into best practices for the performance management calendar, including flash reports, management reporting decks, visualizations, and telling a complete story of the business.

- Structuring management reporting decks that move the needle

- Matching visualizations to the story behind the numbers

- Impacting strategic decisions through effective financial presentations

Module 8

Preparing for the future of FP&A

The final module of the program covers best practices for using emerging technologies, including generative AI and machine learning. In addition, we cover the FP&A recruiting process from common interview questions and answers to typical case studies.

- How AI is changing the FP&A function

- Introduction to generative AI in finance and machine learning

- FP&A interview preparation

Faculty & speakers

-

Christopher Ittner

Professor of Accounting, Accounting Department Chair, Wharton SchoolView Bio -

Christian Wattig

FP&A Program Director,

Wall Street Prep (ex Unilever, P&G, Squarespace)View Bio

-

Glenn Hopper

Chief Financial Officer,

Eventus Advisory GroupView Bio -

Neil Hoyne

Chief Measurement Strategist, GoogleView Bio -

Jessica T. Graziano

Senior Vice President, Chief Financial Officer, U.S. SteelView Bio -

Josette Leslie

Chief Financial Officer,

Affinity.coView Bio -

Debbie Sebastian

![Company logo]() Chief Financial Officer,

Chief Financial Officer,

Eagle Family Foods GroupView Bio

-

Jack Alexander

Principal, Jack Alexander

& Associates LLCView Bio -

Paul Barnhurst

Founder, The FP&A GuyView Bio -

Nicolas Boucher

Founder, AI Finance ClubView Bio -

Alan Brooke

Senior Instructor, Wall Street PrepView Bio -

Jim Chen

Senior Instructor, Wall Street PrepView Bio -

Bill Coda

Senior Instructor, Wall Street PrepView Bio -

Chad Eatinger

Senior Instructor, Wall Street PrepView Bio -

Aviad Haimi-Cohen

Senior Instructor, Wall Street PrepView Bio -

Frank Garafalo

Chief Financial Officer, Eden CapitalView Bio -

Jessica T. Graziano

Senior Vice President, Chief Financial Officer of U.S. SteelView Bio -

Glenn Hopper

Chief Financial Officer, Eventus Advisory GroupView Bio -

Neil Hoyne

Chief Measurement Strategist, GoogleView Bio -

Guy Hutchinson

Co-founder, Startup Chief Financial OfficerView Bio -

Christopher Ittner

Professor of Accounting, Accounting Department Chair, Wharton SchoolView Bio -

Diana Kawarsky

Senior Instructor, Wall Street PrepView Bio -

Josette Leslie

Chief Financial Officer, Affinity.coView Bio -

Anders Liu-Lindberg

Co-founder, Business Partnering InstituteView Bio -

Marcela Martin

President of BuzzFeedView Bio -

Jason McClain

Senior Instructor, Wall Street PrepView Bio -

Ron Monteiro, CPA, CMA

FP&A Consultant & TrainerView Bio -

Mark Potter

Senior Instructor, Wall Street PrepView Bio -

Christopher Reilly

M&A and FP&A ConsultantView Bio -

Debbie Sebastian

Chief Financial Officer at Eagle Family Foods GroupView Bio -

Saloni Varma

Chief Financial Officer, ThorneView Bio -

Christian Wattig

FP&A Program Director,

Wall Street PrepView Bio

Tuition & payment options

OR

Join a Global Network

Join a Global Network

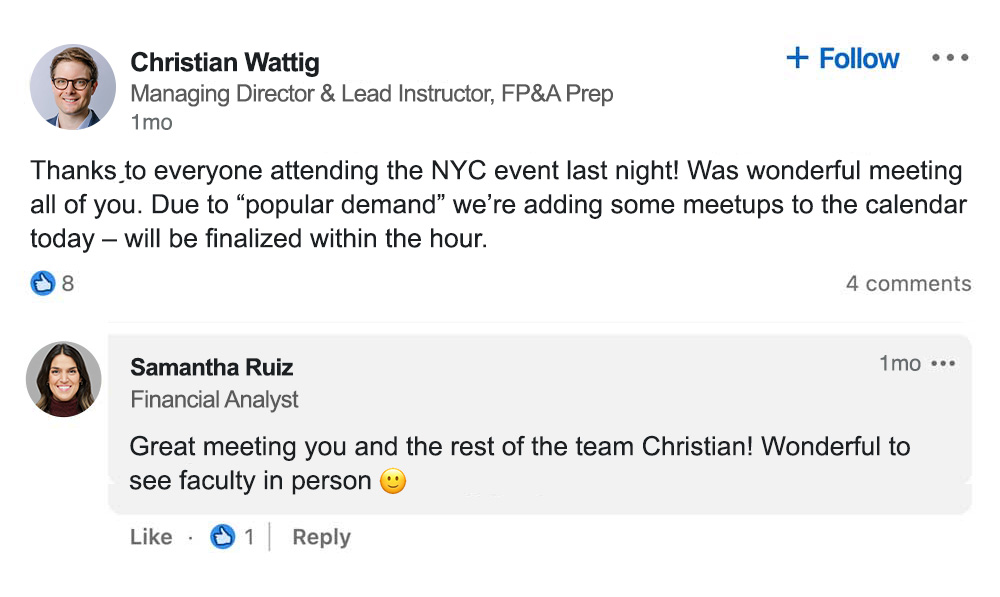

Enrollees access a large and highly engaged global network of peers who are committed to give us much as they get and to support one another. Connections built throughout the program are strengthen via in person and virtual meetups, discussion groups and networking events.

Invitation-Only Wharton/Wall Street Prep Group on LinkedIn

Upon completion of the program, graduates receive an invitation to join the Wharton Online / Wall Street Prep Financial Planning & Analysis (FP&A) Certificate Program Alumni Group on LinkedIn. Through this group, graduates can directly connect with the entire graduate network, seek advice and access graduate-only online events and resources.

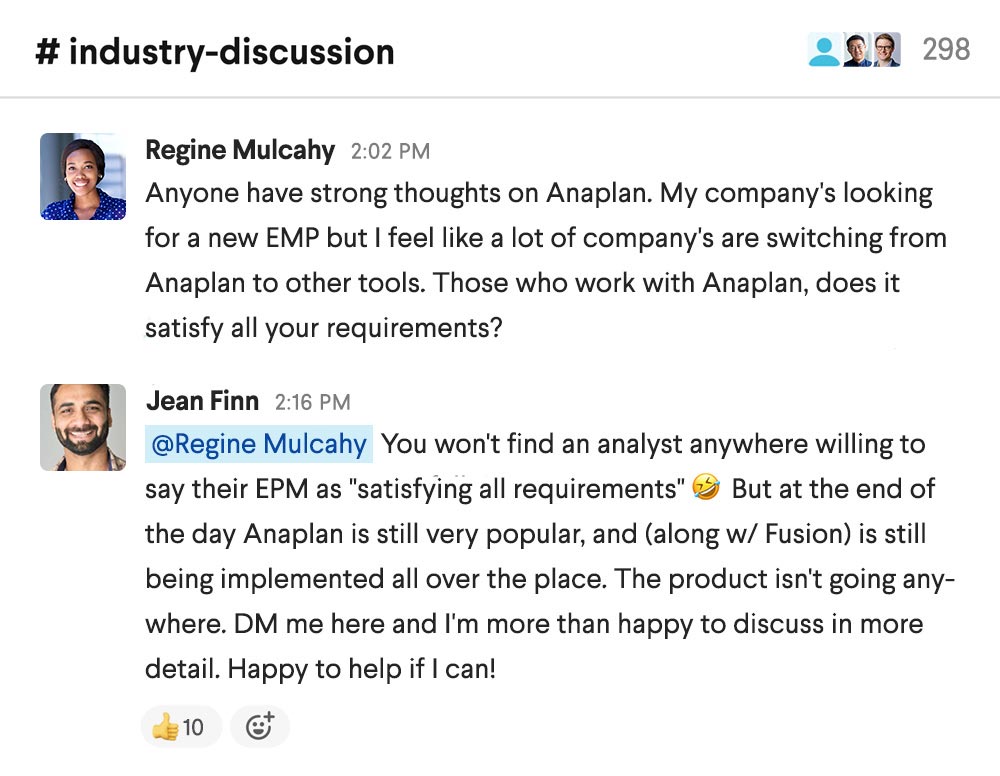

Local Connection for a Global Certificate

Program participants come from over 40 countries, so while the program is global, connection is often created locally. Graduates gain access to their Local Alumni Slack Channel, designed to facilitate local connection for a global certificate.

Cross-Program Networking Events

Enrolling in a Wharton Online & Wall Street Prep Certificate Program is a unique opportunity to expand your professional network beyond your specific industry. Enrollees attend cross-program events attended by other Certificate Program learners and graduates in investment banking, private equity, hedge funds, asset management, venture capital, real estate and other career tracks.

For Employers: Level up your professional development

Small Companies

- Learn to communicate financial insights compellingly to attract investors and secure funding.

- Master efficient methods to analyze financial health and identify growth opportunities with limited resources.

- Gain forecasting skills vital for cash flow management and strategic decision-making.

Mid-Sized Companies

- Align your team's reporting with expansion goals and conveying complex data to stakeholders with clarity.

- Improve skills in identifying, assessing, and mitigating financial risks.

- Dive deeper into financial metrics to drive profitability and manage the increased complexity of your business operations.

Large Enterprises

- Develop your team's influencing skills, enabling them to impact company-wide strategic decisions.

- Integrate global trends and complex variables into long-term planning and risk management.

- Enhance cross-functional collaboration to align business units with firm-wide goals.

Speak With Us About Enrolling Your Team

FAQs

How often are programs offered?

Programs will be offered three times each year. Cohorts will begin in January, May, and September.

How much time will it take to complete this certificate?

The course is designed to run for eight weeks, with a recommended workload of 8-10 hours of lectures, live sessions, and assignments per week.

What languages will the program be offered in?

This program is offered in English only.

How do I register for this program?

You can register for the program at any time through our Enrollment Form.

How much does the program cost?

Program tuition is $5,000. Tuition can be paid in full or in 5 monthly payments.

Do you offer tuition assistance?

Tuition assistance will be available for every cohort. Use our Tuition Assistance form to apply.

What is the program refund policy?

This program is non-refundable.

Who can I contact for additional questions?

If you have any additional questions, please reach out to our enrollment team at enrollment@wharton.wallstreetprep.com.