Get the brochure

View the full program syllabus as well as details on faculty, guest speakers and key learner benefits.

Program overview

Learn value investing from the world's top investors and world-renowned faculty

-

Learn to identify undervalued stocks

Warren Buffett famously said "Price is what you pay. Value is what you get." This program delivers an actionable framework for identifying undervalued stocks with the process-driven approach used by the world’s top investors.

-

Gain a tangible value investing skill set

This value investing course is for individual investors, investment advisors, and institutional investors seeking to put value investing strategies into practice. Learn directly from Wharton School faculty and the world’s top investors.

-

Earn a globally recognized certificate

Upon successful completion of the program, participants receive a digital certificate from Wharton Online and join a global community of institutional investors, investment advisors, and individual investors.

Learn from world-renowned faculty and leading institutional investors

-

Nicolaj Siggelkow

David M. Knott Professor of Management, Wharton SchoolView Bio -

David Musto

Ronald O. Perelman Professor in Finance, Wharton SchoolView Bio -

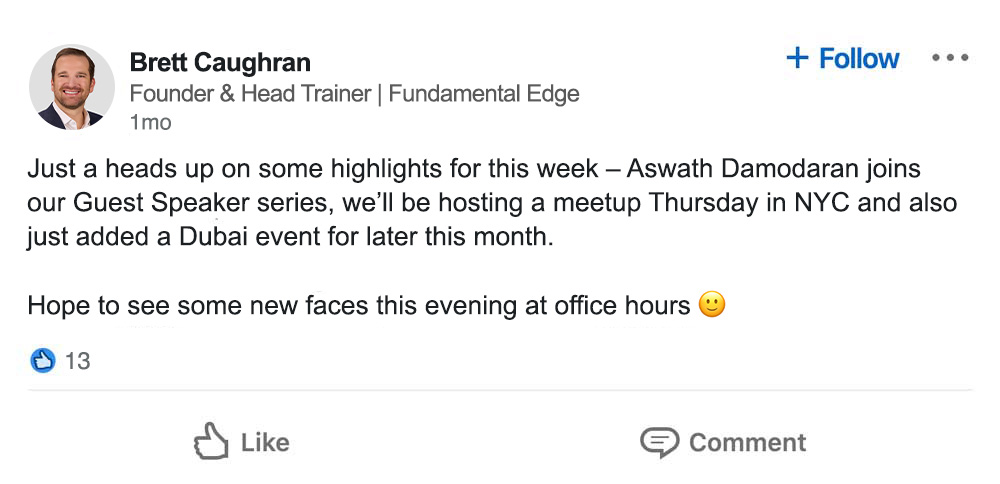

Brett Caughran

Value Investing Program Director, Wall Street PrepView Bio -

Paul Johnson

Value Investing Program Co-Director, Wall Street PrepView Bio -

Andrew Carr

Value Investing Program Co-Director, Wall Street PrepView Bio

-

Ricky Sandler

Founder & CEO, Eminence CapitalView Bio -

Guy Spier

![Company logo]() General Partner, Aquamarine; Author of "The Education of a Value Investor"View Bio

General Partner, Aquamarine; Author of "The Education of a Value Investor"View Bio -

David Samra

![Company logo]() Managing Director, Artisan PartnersView Bio

Managing Director, Artisan PartnersView Bio -

Jeff Gramm

![Company logo]() Founder & Managing Partner, Bandera Partners; Author of "Dear Chairman"View Bio

Founder & Managing Partner, Bandera Partners; Author of "Dear Chairman"View Bio -

Howard Marks

Co-founder, Oaktree CapitalView Bio -

Francois Trahan

President, Macro Specialist DesignationView Bio -

Michael Gatto

Partner, Silver Point FinanceView Bio -

Michael Mauboussin

Head of Consilient Research, Counterpoint GlobalView Bio -

Robert Hagstrom

Chief Investment Officer, EquityCompassView Bio -

Freddy Brick

Partner, Muddy Waters CapitalView Bio

-

Stefan Allicock

Senior Instructor, Wall Street PrepView Bio -

Shawn Badlani

Founder and Chief Investment Officer, Honest Capital LLCView Bio -

Freddy Brick

Partner, Muddy Waters CapitalView Bio -

Rocky Cahan

US Strategist, Empirical Research PartnersView Bio -

Andrew Carr

Value Investing Program Co-Director, Wall Street PrepView Bio -

Brett Caughran

Value Investing Program Director, Wall Street PrepView Bio -

Rishi Dixit

Senior Analyst, Valiant CapitalView Bio -

Michael Gatto

Partner, Silver Point FinanceView Bio -

Jeff Gramm

![Company logo]() Founder & Managing Partner, Bandera Partners; Author of "Dear Chairman"View Bio

Founder & Managing Partner, Bandera Partners; Author of "Dear Chairman"View Bio -

Robert Hagstrom

Chief Investment Officer, EquityCompassView Bio -

Paul Johnson

Value Investing Program Co-Director, Wall Street PrepView Bio -

Samantha Kandybowicz, CFA

Senior Instructor, Wall Street PrepView Bio -

Jen Liang, CFA

Senior Instructor, Wall Street PrepView Bio -

Howard Marks

Co-founder, Oaktree CapitalView Bio -

Michael Mauboussin

Head of Consilient Research, Counterpoint GlobalView Bio -

David Musto

Ronald O. Perelman Professor in Finance, Wharton SchoolView Bio -

Matt Ober, CAIA

![Company logo]() General Partner, Social LeverageView Bio

General Partner, Social LeverageView Bio -

Alix Pasquet

Managing Partner, Prime Macaya Capital ManagementView Bio -

Mark Potter

Senior Instructor, Wall Street PrepView Bio -

David Samra

![Company logo]() Managing Director, Artisan PartnersView Bio

Managing Director, Artisan PartnersView Bio -

Ricky Sandler

Founder & CEO, Eminence CapitalView Bio -

Nicolaj Siggelkow

David M. Knott Professor of Management, Wharton SchoolView Bio -

Guy Spier

![Company logo]() General Partner, Aquamarine; Author of "The Education of a Value Investor"View Bio

General Partner, Aquamarine; Author of "The Education of a Value Investor"View Bio -

Kelvin Teo

Senior Instructor, Wall Street PrepView Bio -

Francois Trahan

President, Macro Specialist DesignationView Bio

8-Week Applied Value

Investing Program

8-10 Hour Weekly

Time Commitment

Self-paced Online

Learning Experience

The Same Training Used

by Institutional Investment Firms

How You'll Learn

How You'll Learn

The Wharton & Wall Street Prep Applied Value Investing Certificate Program is an immersive learning experience made up of self-paced video lectures, real-world exercises, industry case studies and full faculty support.

Learn From Top Institutional Investors

Tailored Learning

Through Electives

Learn Real World

Stock Pitching

Weekly Office Hours

& Dedicated Support

Program curriculum

Over the course of eight weeks, you’ll learn the history, foundations, and applications of value investing, competitive analysis and strategy as well as the practical frameworks and technical skills that investment professionals use to evaluate opportunities. This investment certification program is delivered in a weekly self-paced online format and culminates in a closing ceremony and the receipt of a Certificate from Wharton Online.

Module 1

Introduction to Value Investing

Week 1 is an introduction to Value Investing with an overview of the history and discussion of the principles applied by value investors. Supplementing Week 1 will be a guest speaker panel with Ricky Sandler of Eminence Capital. Ricky will discuss an “in the trenches” view of the investment philosophy and approach that he has honed over decades of successful experience on the buy-side.

- History of Value Investing

- Fundamental (value) investing explained

- Introduction of the relationship between Price (P) and Value (V)

- Value investing principles

Module 2

Market Efficiency, Stock Price Movements, and Market Mispricing

Module 2 lays down the groundwork concepts of market efficiency, indexing, and alpha measurement. Learners will be introduced to frameworks for understanding and attributing stock price movements to specific underlying factors. The module concludes with situations where the market offers mispricing, expectations gaps in stock investing, and the many faces of mispricing, and introduce a framework for solid fundamental investing.

- An academic vs. practitioner's view of market efficiency

- The Wisdom of Crowds

- Why stocks move up & down

- The importance of investor expectations

- Variant perspective, analytical edge, and catalysts

Module 3

Intrinsic Value

Students will conduct a deep dive on a business to understand its moats as well as the primary drivers of a company’s value. As part of the research process, students will learn how to evaluate revenue growth and how it influences a stock’s value as it flows through the company’s financials. The content also will cover how to discern why an investment opportunity exists and articulate the catalyst path to stock price movement.

- Foundations of Corporate Finance

- The drivers of value: ROIC, Growth, Reinvestment

- Cost of capital and capital structure

- Measuring and Forecasting Performance

- Profitability Metrics and Multiples (EPS, P/E, EV/EBITDA)

- Introduction to Valuation: Concepts and Methods

- Relative valuation (comparable company analysis)

- Intrinsic valuation (discounted cash flow analysis)

Module 4

Institutional-Grade Value Investing, Part 1

Students will conduct a deep dive on a business to understand its moats as well as the primary drivers of a company’s value. As part of the research process, students will learn how to evaluate revenue growth and how it influences a stock’s value as it flows through the company’s financials. The content also will cover how to discern why an investment opportunity exists and articulate the catalyst path to stock price movement

- Capital Markets Foundations & The IPO Process

- The FEV (fundamentals, expectations, valuation) Framework

- Building a Forecasting Architecture

- Top-7 "must-haves" for a Portfolio Manager in a model

- Full overview of a deep dive process

- Model sections, including comps/DCF/deep dive analysis/earnings power

- How to effectively read and interpret company reports

- Fundamentals of a Management Quality Assessment

- Ingredients of "Everything There Is To Know" ("ETIK")

Module 5

Institutional-Grade Value Investing, Part 2

Module 5 builds on the learning objectives of the prior module, focusing on practical aspects of developing a contrarian thesis. The module consludes with a deep dive into a company’s competitive strategy, barriers to entry, and differentiation.

- Practical tools for developing a contrarian thesis: Sentiment analysis, evaluating insider buying, and understanding herd mentality

- Assessing the competitive advantages of a business

- Impact of barriers to entry on return on invested capital (ROIC)

- The Focus Five: top drivers of business value creation

Module 6

Growth, Risk, and Uncertainty

Students will learn about disaggregating growth and assessing expectations. Risk and Uncertainty will also be covered as they tie into evaluating a company’s long-term growth prospects. There is supplemental content on Management, Boards, and Corporate Governance.

- Disaggregating revenue growth to understand key drivers

- Assessing Risk

- Capital allocation, shareholder activism, and corporate governance

Module 7

Process-Driven Value Investing

Students will gain insight into the ins and outs of an applied value investing process through deep dives on topics such as information gathering, model analysis, and crafting a fully-formed thesis. Students will hear from Matt Ober on alternative data and Freddy Brick on short selling.

- Efficiency and the time management during research

- A system for effective information management: Checklists, Scenario Analysis Premortems, an Unkown Unknowns

- The "sniff test" and how to "fish where the fish are"

- The 90% rule for idea selection

Module 8 (ELECTIVE)

Considerations for Investment Professionals on the Buy-Side

- Buy-Side Career Trajectory: This elective module focuses on considerations specific to students pursuing professional investment roles on the "buy-side". Students will learn how to most effectively allocate time in both rolling out and maintaining coverage as well as a process for relentlessly tracking core metrics across their sector coverage

- Pitching a Stock: This module is focused on taking a stock thesis and communicating it to others. Students will learn how to present an idea to audiences including PMs or other investors. Students will hear from Francois Trahan on Macro frameworks for equity analysts.

- The active management EcosystemIn this capstone, students will learn about the various avenues in which value investing may be applied including careers and the different traits required at different firms as well as how to be a great overall analyst.

Applicant profile

The Wharton & Wall Street Prep Applied Value Investing Certificate Program is designed for individual investors managing their own stock portfolio, investment advisors seeking to better serve clients, aspiring hedge fund analysts seeking to understand institutional-grade value investing, and anyone looking to learn to invest money with an institutional lens.

New Buy-Side Analysts

Sell-Side Research Analysts

Allocators

Family Offices

Wealth Managers

Vendors

Investment Professionals

Career Switchers

Students

At a Glance:

Program Learners & Graduates

Applicant Career Levels

Applicant Industry Distribution

1 Wealth Manager, Financial Planner, Registered Investment Advisor (RIA)

2 Investment Banking, Private Equity, Sell-Side Equity Research

3 Accounting, Data Providers

Countries Represented

Applicant Employers Include ...

Top Roles Applicants Hold

| 1. | Hedge Fund Analyst (Long/Short, Long Only) |

| 2. | Individual Investor |

| 3. | Quantitative Analyst |

| 4. | Sell-Side Research Analyst |

| 5. | Equity Sales & Trading Associate |

| 6. | Wealth Manager |

| 7. | Financial Advisor / RIA |

| 8. | Financial Planner |

| 9. | Investment Banker / Management Consultant |

| 10. | Investment Analyst |

Attend an information session

Tuition & payment options

OR

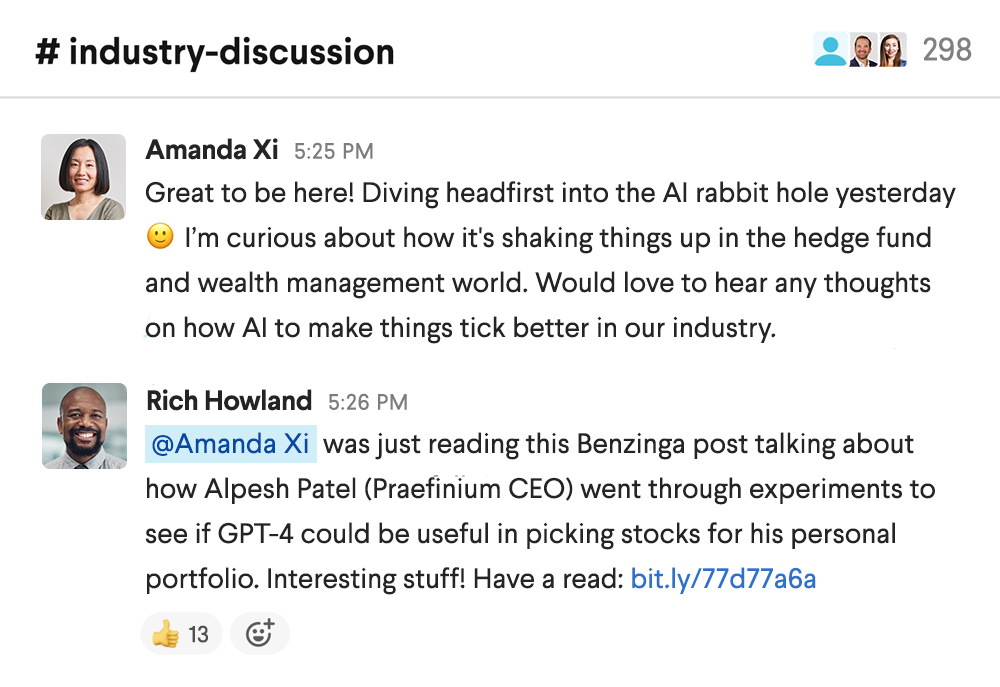

Join a Global Network

Join a Global Career Support Network

Enrollees access a large and highly engaged global network of peers who are committed to give us much as they get and to support one another. Connections built throughout the program are strengthen via in person and virtual meetups, discussion groups and networking events.

Invitation-Only Wharton/Wall Street Prep Group on LinkedIn

Upon completion of the program, graduates receive an invitation to join the Wharton Online / Wall Street Prep Applied Value Investing Certificate Program Alumni Group on LinkedIn. Through this group, graduates can directly connect with the entire graduate network, seek advice and access graduate-only online events and resources.

Local Connection for a Global Certificate

Program participants come from over 40 countries, so while the program is global, connection is often created locally. Graduates gain access to their Local Alumni Slack Channel, designed to facilitate local connection for a global certificate.

Cross-Program Networking Events

Enrolling in a Wharton Online & Wall Street Prep Certificate Program is a unique opportunity to expand your professional network beyond your specific industry. Enrollees attend cross-program events attended by other Certificate Program learners and graduates in investment banking, private equity, real estate, financial planning and analysis (FP&A) and other career tracks.

For Employers: Level up your professional development

Hedge funds

- Accelerate the new-hire training timeline.

- Give freedom back to your senior analysts and portfolio managers by professionalizing your talent development.

- Better compete for talent against large firms with extensive in-house training resources.

Long only, family offices, RIAs and other investment organizations

- Establish best practices in your investment research process.

- Compete with larger firms by adopting best-in-class talent development.

- Focus your executives’ time on their core functions while encouraging improvement in research capabilities.

Vendors

- Better understand how your service/product fits into the fundamental research process.

- Equip your sales force to recognize opportunities to add value across your client’s investment processes.

FAQs

How often are programs offered?

Programs will be offered three times each year. Cohorts will begin in February, June, and October.

How much time will it take to complete this certificate?

The course is designed to run for eight weeks, with a recommended workload of 8-10 hours of lectures, live sessions, and assignments per week.

What languages will the program be offered in?

This program is offered in English only.

How do I register for this program?

You can register for the program at any time through our Enrollment Form.

How much does the program cost?

Program tuition is $4,800. Tuition can be paid in full or in 5 monthly payments.

Do you offer tuition assistance?

Tuition assistance will be available for every cohort. Use our Tuition Assistance form to apply.

What is the program refund policy?

This program is non-refundable.

Who can I contact for additional questions?

If you have any additional questions, please reach out to our enrollment team at enrollment@wharton.wallstreetprep.com.

"This program approaches value investing with the high level of rigor needed to prepare hedge fund analysts, asset managers, and public equities investors for the demands of the desk, but it’s also for individual investors and value investing enthusiasts looking to apply institutional-grade fundamental analysis to identify undervalued, high-potential stocks."

"This program approaches value investing with the high level of rigor needed to prepare hedge fund analysts, asset managers, and public equities investors for the demands of the desk, but it’s also for individual investors and value investing enthusiasts looking to apply institutional-grade fundamental analysis to identify undervalued, high-potential stocks."